Cost of Goods Manufactured Formula

If you dont account for your cost of goods sold your books and financial statements will be inaccurate. The cost of sales formula can be calculated two different ways.

Cost Of Goods Manufactured Template Download Free Excel Template

The company purchases raw materials and uses labour to produce goods that it sells and the total value for the same is 5000.

. Some systems permit determining the costs of goods at the time acquired or made but assigning costs to goods sold under the assumption that the goods made or acquired last are sold first. Let us say that company X is producing five hundred units of masks at the cost of 10000 rupees. Follow the formula below to calculate your COGS.

The budget includes every cost related to the production process other than costs related to direct material Direct Material Direct materials are raw materials that are directly used in the manufacturing process of a companys goods andor services and are an essential component of the finished goods manufactured. Heres what this formula looks like in practice. Last-In First-Out LIFO is the reverse of FIFO.

A higher cost of goods sold means a company pays less tax but it also means a company makes less profit. The formula for cost of goods sold makes adjustments for opening and closing inventories of all types of inventory ie raw materials work in progress and finished goods. Marginal Cost Of Production.

Its end-of-year value is subtracted from its beginning of year value to find cost of goods sold. To calculate the cost of goods sold use the following formula. Along with this the import costs for parts and materials as well as the costs involved in marketing or selling the product are included in calculating the cost of goods sold.

Something needs to change. Costs of the goods manufactured. The marginal cost of production is the change in total cost that comes from making or producing one additional item.

Cost of goods should be minimized in order to increase. The company then manufactures an additional one hundred units for 5000 rupees. The below section deals with calculating cost of goods sold.

What is the definition of cost of sales. The cost of sales is more than just including the costs of raw materials or the resources that are used up in manufacturing the product. Beginning inventory net purchases or new inventory - ending inventory COGS.

Your business has 10000 in inventory at the start of the year You buy 9000 in new products during the year. Inventory limited reported goods sales numbers this quarter. The Gross profit was reported as better than in the previous quarter.

COGS Beginning inventory purchases during. The company reported 230000 as of the opening stock 450000 as closing stock and 1050000 as net purchases. Production Cost per Unit 3 per piece 300 per piece which is less than the bidding price.

Calculating Cost of Goods Sold. Cost of Goods Sold Formula Example 1. Read more and direct labor.

Lets take the example of company A which has a beginning inventory of 20000. You can adjust the cost of the goods purchased or manufactured by the change in inventory during a given period. The purpose of analyzing marginal cost is to.

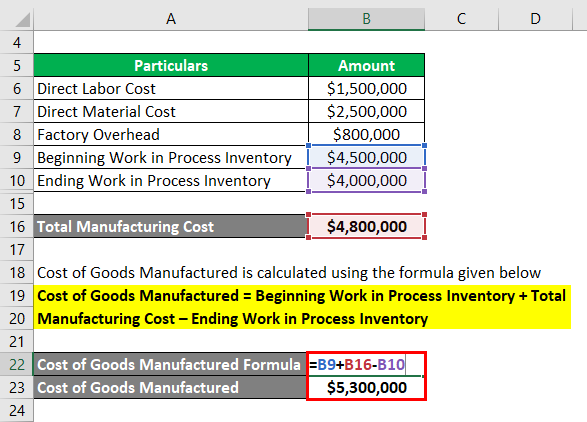

Before you can jump into learning about recording cost of goods sold journal entry you need to know how to calculate COGS. Second Mary adds the beginning inventory and subtracts the ending inventory to calculate the cost of goods manufactured. Therefore the company should go ahead with the bidding process.

The oldest cost ie the first in is then matched against revenue and assigned to cost of goods sold. Marginal cost can be calculated by dividing the change in total cost by the change in quantity. Production Cost per Unit 105 million 350 million.

The article cost of goods manufactured vs cost of goods sold looks at meaning of and differences between these two types of derived costs. Cost of Sales Formula³.

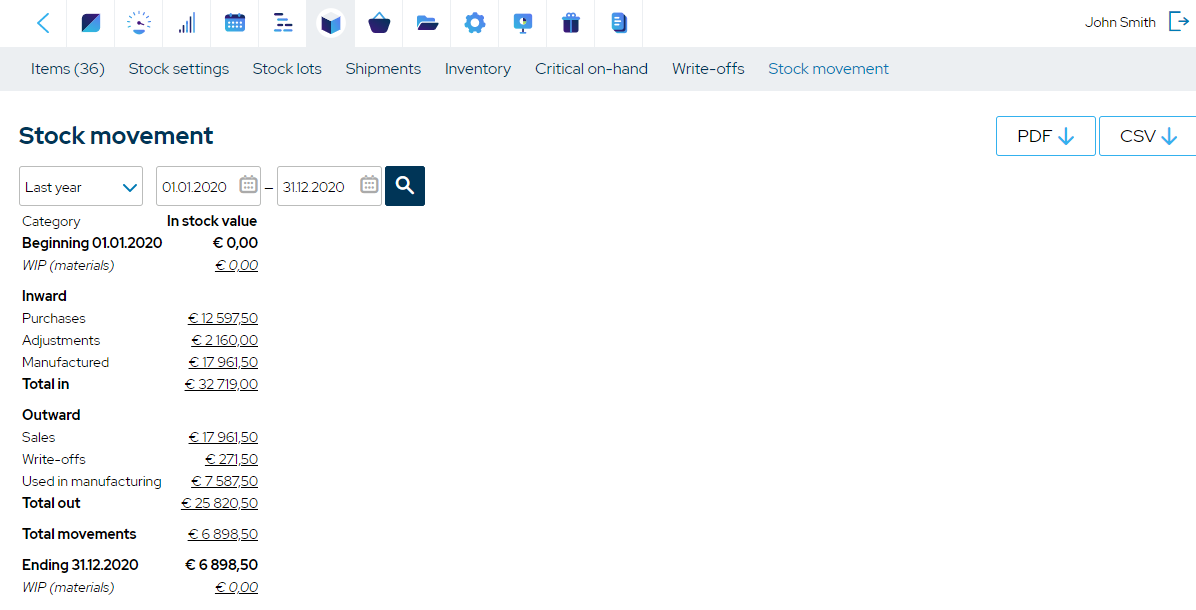

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

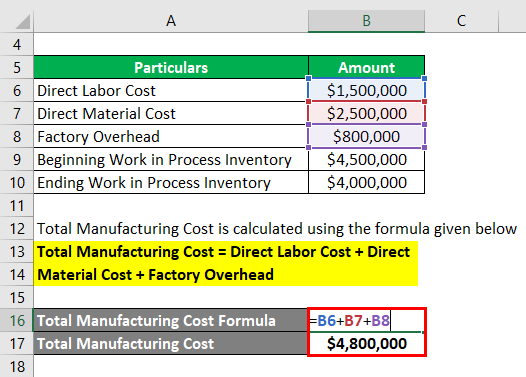

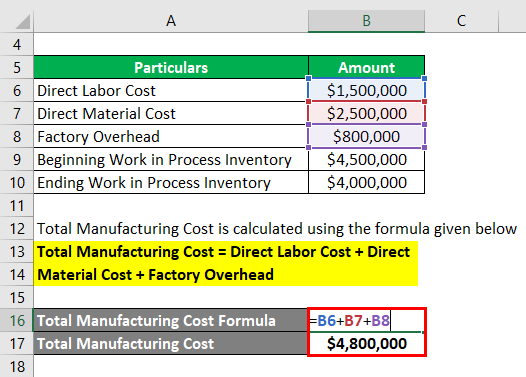

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

No comments for "Cost of Goods Manufactured Formula"

Post a Comment